Home Sellers in Q3 Netted $61K at Resale

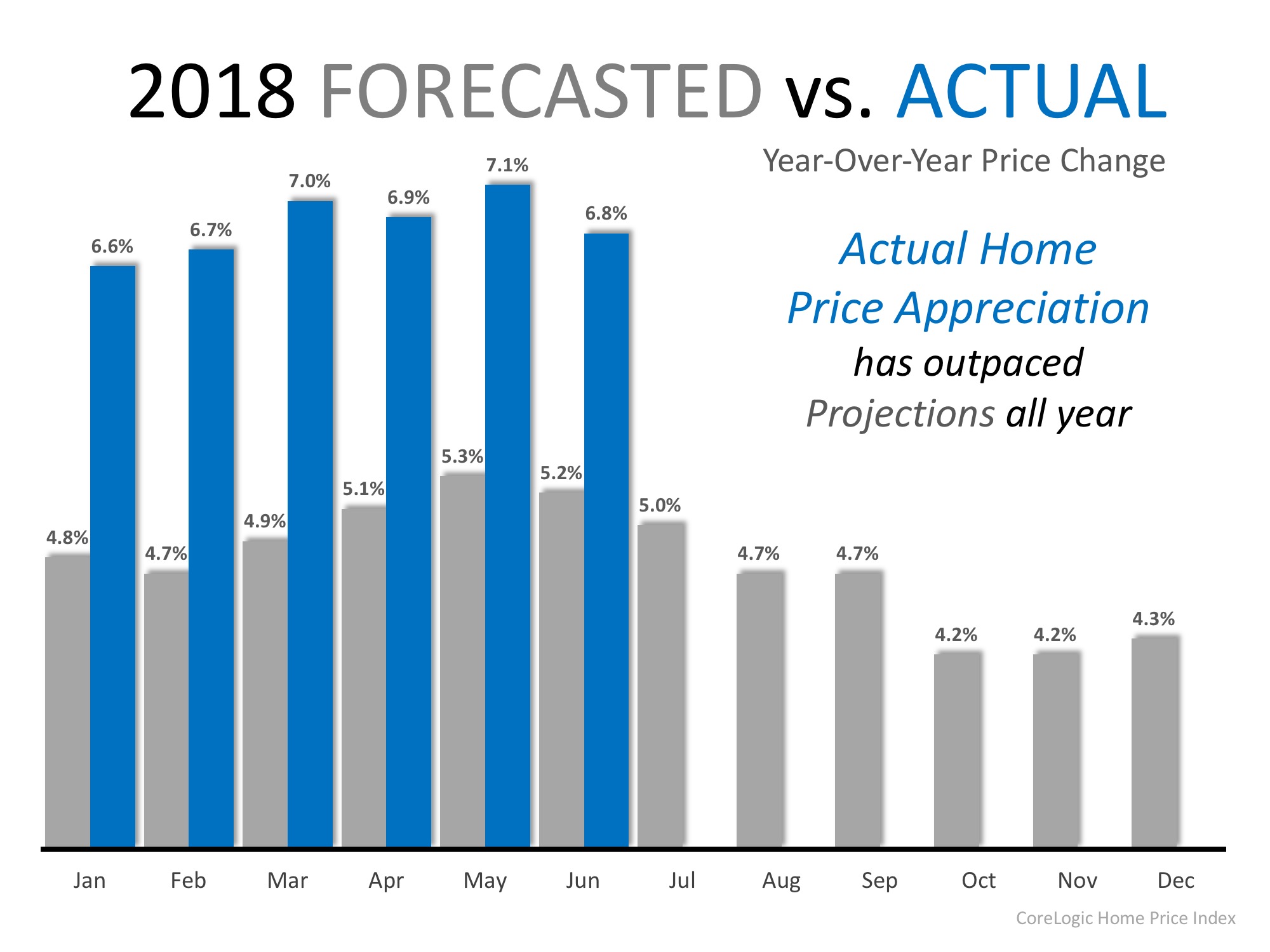

According to a recent report by ATTOM Data Solutions, home sellers who sold their homes in the third quarter of 2018 benefited from rising home prices and netted an average of $61,232.

This is the highest average price gain since the second quarter of 2007 and represents a 32% return on the original purchase prices.

After the Great Recession, many homeowners were left in negative equity situations but home price appreciation in the recovery period since then has given homeowners something to smile about.

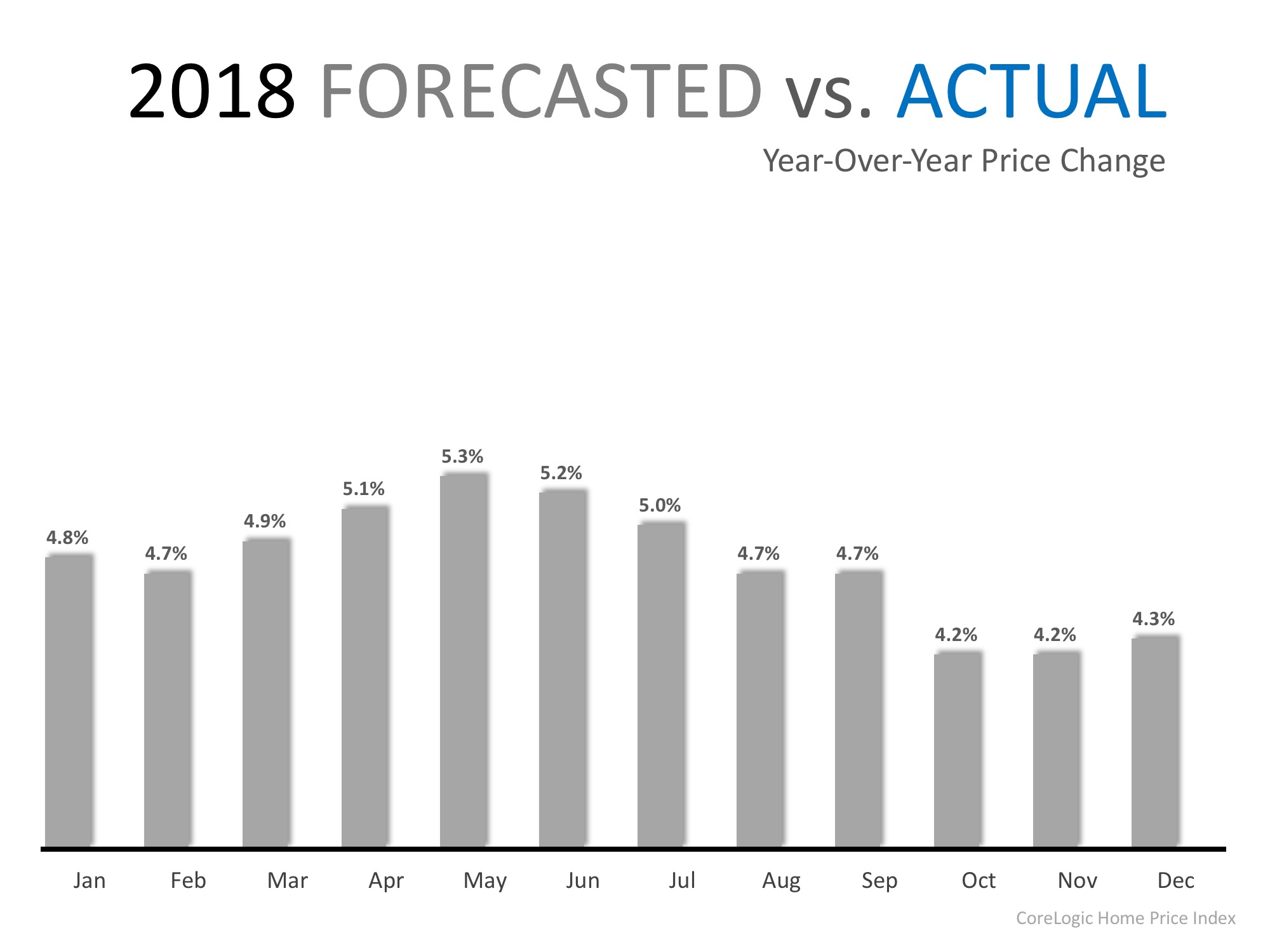

The results from ATTOM fall right in line with data from the latest edition of the National Association of Realtors’ (NAR) Profile of Home Buyers and Sellers. Below is a chart that was created using NAR’s data to show the percentage of equity that homeowners earned at the time of sale based on when they purchased their homes.

Even though those who purchased at the peak of the market netted less than those who bought before and after the peak, the good news is that there was a double-digit profit to be had! Many homeowners believe that they are still underwater which has led many of them to not even consider selling their houses.

Bottom Line

If you are curious about how much equity you’d earn if you sold your home, let’s get together to perform an equity review and determine the demand for your home in today’s market! Contact Your Real Estate Family - Contact The Gary & Nikki Team today or call - 727-787-6995.

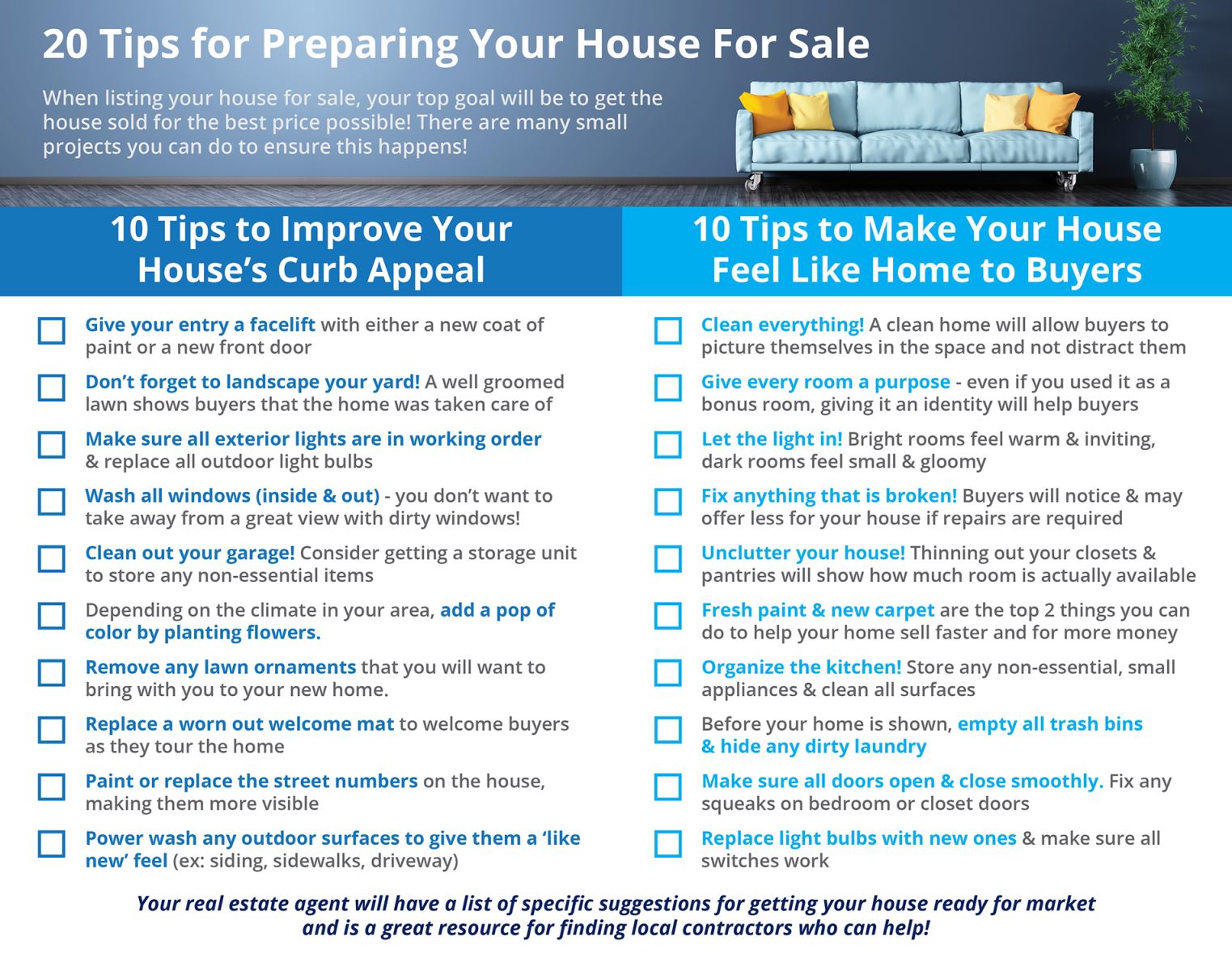

Take the first step in putting your home up for sale. Find out how much it could sell for.

Get a FREE, INSTANT home valuation. Click HERE.