FSBO, List Again or OTM? A Seller’s Dilemma

At the end of December, in every region of the country, hundreds of homeowners have a tough decision to make. The ‘listing for sale agreement’ on their house is about to expire and they now must decide to either take their house off the market (OTM), For Sale by Owner (FSBO) or list it again with the same agent or a different agent.

Let’s assume you or someone you know is in this situation and take a closer look at each possibility:

Taking Your Home off the Market

In all probability, after putting your house on the market and seeing it not sell, you’re going to be upset. You may be thinking that no one in the marketplace thought the house was worthy of the sales price.

Because you are upset, you may start to rationalize that selling wasn’t that important after all and say,

“Well, we didn’t really want to sell the house anyway. This idea of making a move right now probably doesn’t make sense.”

Don’t rationalize your dreams away. Instead, consider the reasons you decided to sell in the first place. Ask your family this simple question:

“What made us originally put our home up for sale?”

If that reason made sense a few months ago when you originally listed the house, chances are it still makes sense now. Don’t give up on what your family hoped to accomplish or on goals your family hoped to attain.

Just because the house didn’t sell during the last listing contract doesn’t mean the house will never sell or that it shouldn’t be sold.

Re-Listing with your Existing Agent

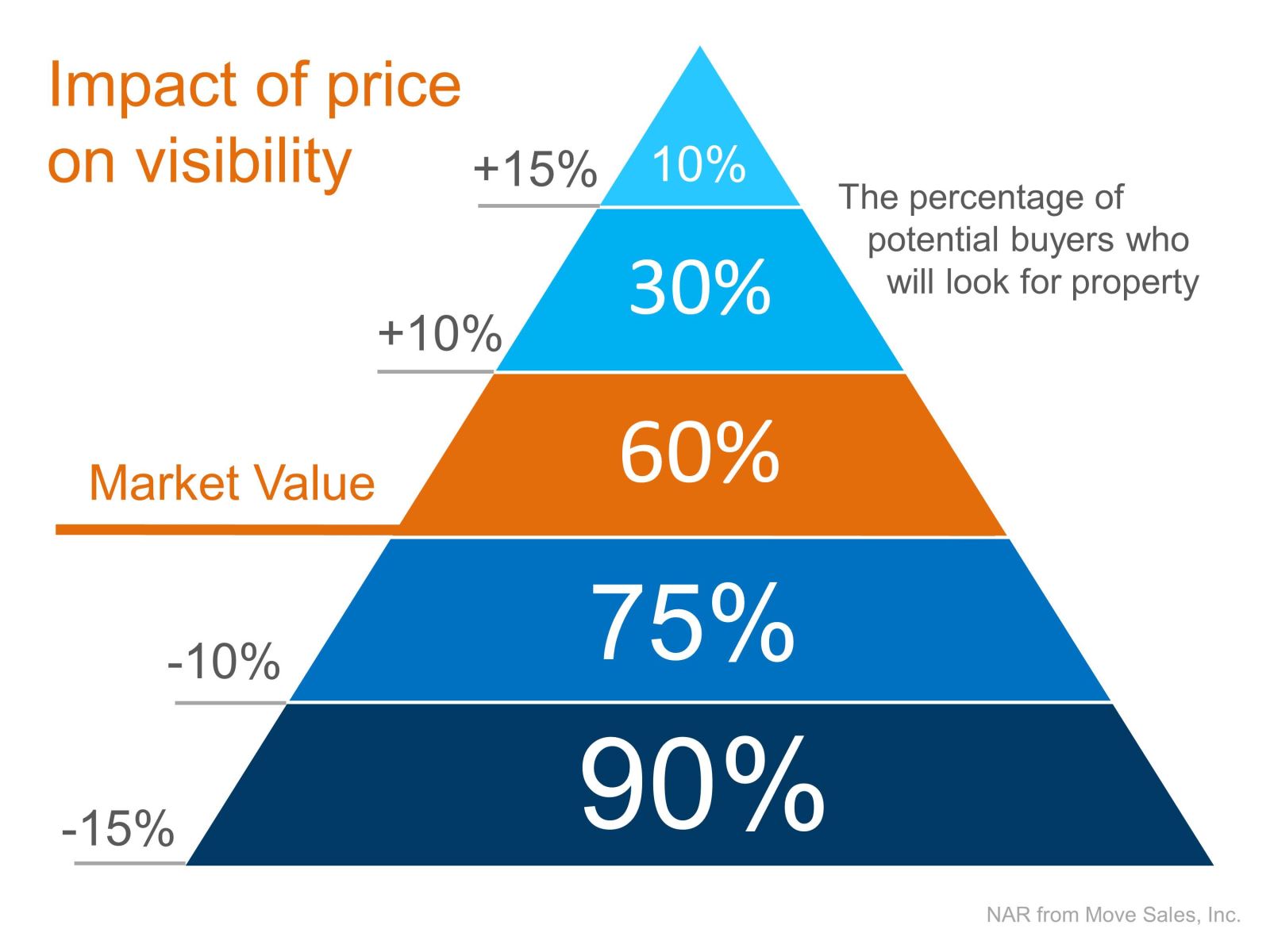

For whatever reason, your house did not sell. Perhaps you now realize how difficult selling a house may be or that the listing price was too high, or perhaps you’re now acknowledging that you didn’t exactly listen to your agent’s advice.

If that is the case, you may want to give your existing agent a second chance. That’s a perfectly okay thing to do.

However, if your agent didn’t perform to the standard they promised when they listed your home you may want to either FSBO or try a different agent.

For Sale by Owner

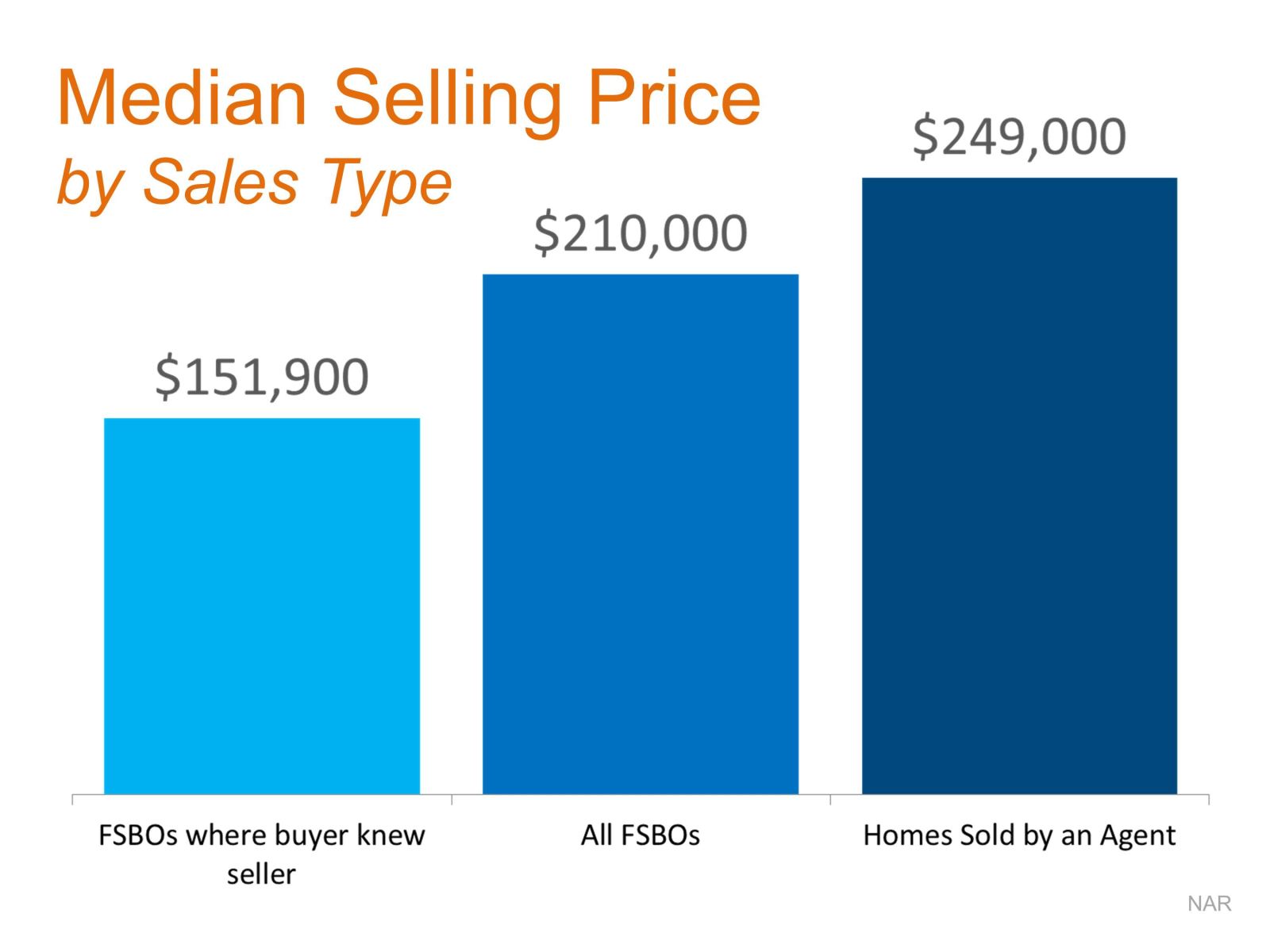

You may now believe that listing your house with an agent is useless because your original agent didn’t accomplish the goal of selling the house. Trying to sell the house on your own this time may be alluring. You may think you will be in control and save on the commission.

But, is that true? Will you be able to negotiate each of the elements that make up a real estate transaction? Are you capable of putting together a comprehensive marketing plan? Do people who FSBO actually ‘net’ more money?

If you are thinking about FSBOing, take the time to first read: 5 Reasons You Shouldn’t For Sale by Owner.

List with a New Agent

After failing to sell your home, you may no longer trust your agent or what they say. However, don’t paint all real estate professionals with that same brush. Have you ever gotten a bad haircut before? Of course! Did you stop getting your hair cut or did you simply change hair stylists?

There is good and bad in every profession—good and bad hair stylists, agents, teachers, lawyers, doctors, police officers, etc. And just because there are good and bad in every line of work doesn’t mean you don’t call on others for the products and services you need. You still get your haircut, see a doctor, talk to a lawyer, send your kids to school, etc.

Bottom Line

You initially believed that using an agent made sense. It probably still does. Contact The Gary & Nikki Team today. Put our 30 years of experience to work for you. 727-787-6995